Blue Property

Blue Property Overview

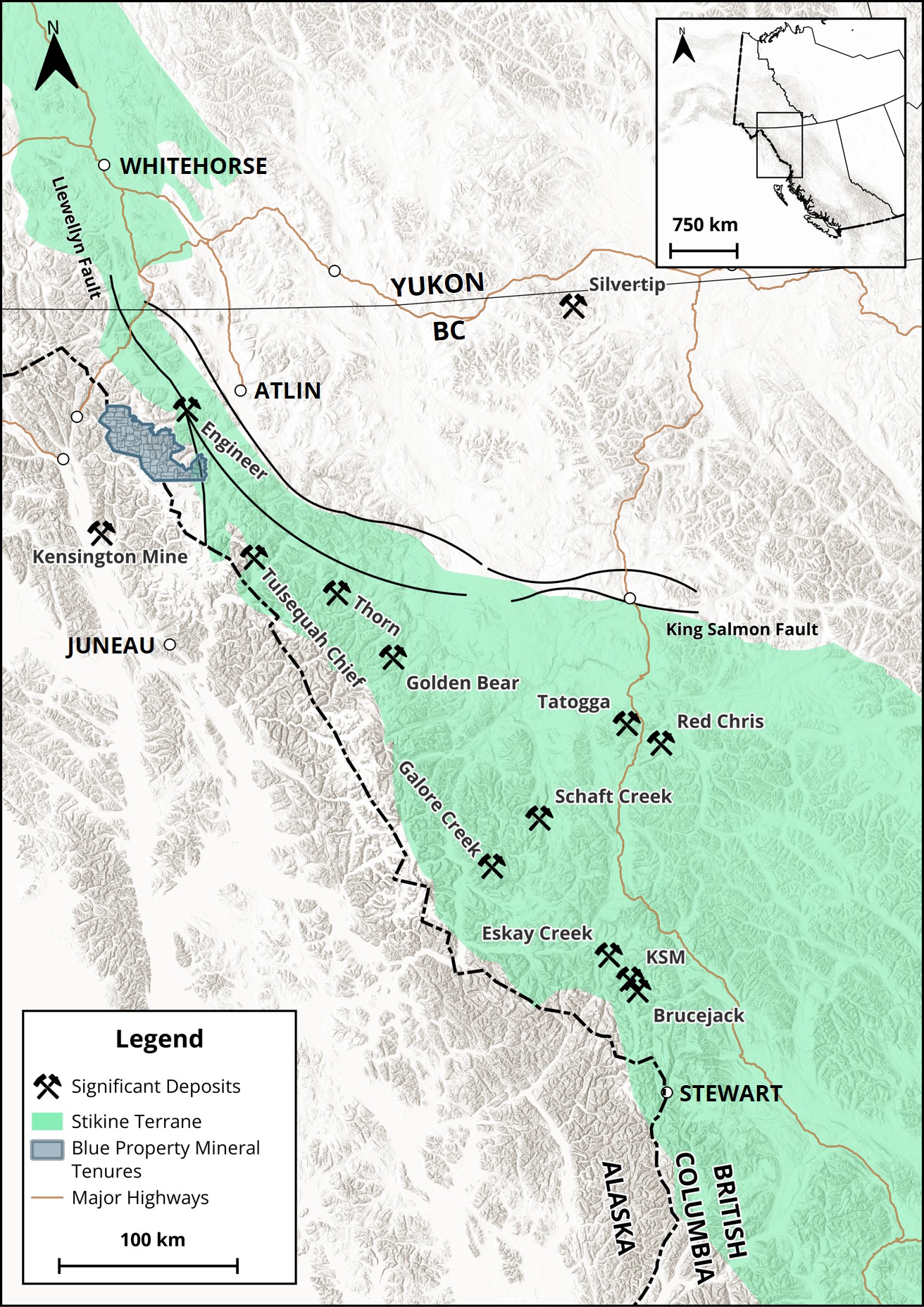

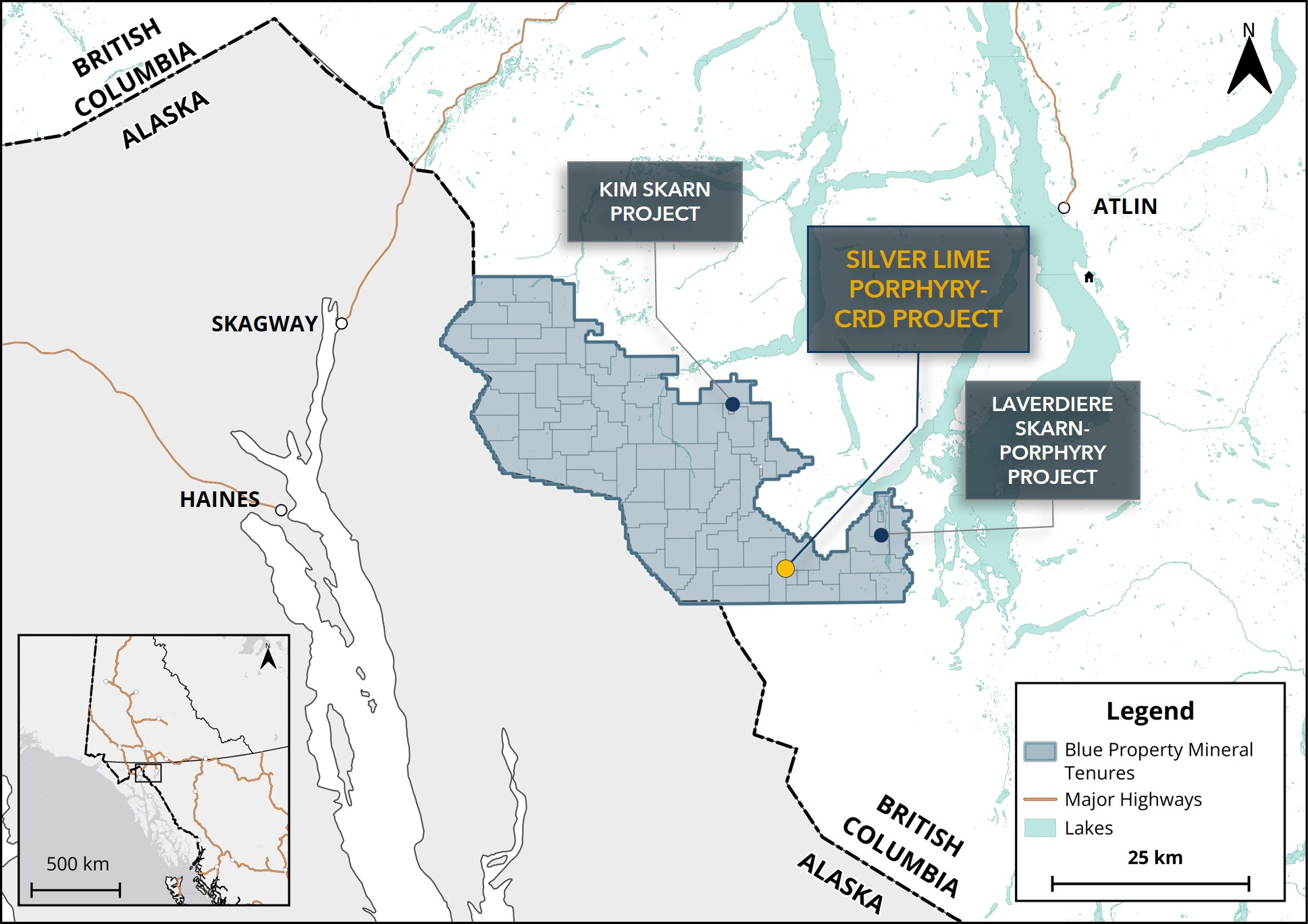

The Blue Property is located in the last unexplored area of British Columbia's prolific Stikine Terrane. The Property currently consists of three projects with a combined total 11 high-grade exploration targets. These targets span several mineral deposit types including Mo-Cu-bearing porphyries with associated with copper or copper-zinc-silver rich skarn deposits, silver-lead-zinc-copper rich massive sulphide carbonate replacement deposits (CRD's), and distal base metal-gold-silver vein assemblages. At the center of the Blue Property Tenure, the Silver Lime Project contains one of the largest and highest grade, documented surficial expressions of any early-stage CRD Project. Silver Lime contains impressive copper, molybdenum, silver, zinc, lead, and gold-bearing ore styles that span the full Porphyry-Skarn-Carbonate Replacement mineralization spectrum.

Location, Access & Infrastructure

The Blue Property Tenure is located 48 kilometers southwest of the community of Atlin, British Columbia in the traditional territories of the Taku River Tlingit First Nation and the Carcross-Tagish First Nation.

The Property covers an impressive and contiguous land area of 114,074 hectares (1,140 km²) and can be accessed year-round via a 15-minute helicopter flight from the Atlin Airstrip. Atlin and Tagish lakes provide cost-effective means for mobilizing exploration materials in an efficient and environmentally friendly manner, as well as providing a potential option for future low-cost ore transport.

All services necessary for exploration including accommodations, transportation, heavy equipment, and expediting services are available in Atlin. All other necessary services are available in Whitehorse, YT which is highway accessible and located 170 kilometers north of Atlin.